COVID-19: Weighing the Risks of Going Out

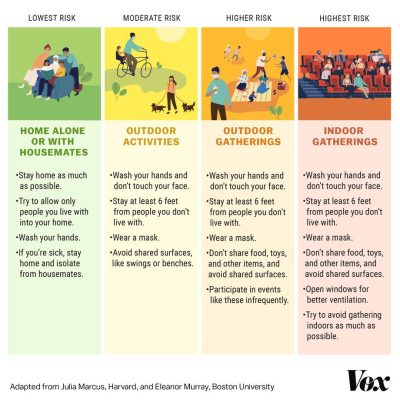

Since COVID-19 lock downs began in the US, most Americans have drastically changed their patterns: following instructions to stay home, limiting almost all contact with others, and venturing out only for essential trips and exercise. Americans are getting tired of staying inside. All states have re-opened at different levels. As states begin to ease social distancing restrictions, people are beginning to have more options. Between those wanting to patronize newly reopened businesses or socialize in person, and more employers calling people back to work. The safest thing anyone can do in the middle of the Covid-19 outbreak is still the same as it was a few months ago: Stay home as much as possible to avoid catching or spreading the virus until there is a vaccine or effective treatment, or until the pandemic otherwise ends. That especially applies to people who are sick, who should do all they can to avoid exposing others to the coronavirus. But for many people, it’s really not clear which kinds of gatherings are safe and which aren’t. And that uncertainty can spark anxiety. Fortunately, health experts know more about the COVID-19 than they did when the lock downs began, and they can point us to different levels of risk as we begin to reengage. First and foremost, the advice that has been repeated for much of the past few months remains true: Your home is still the safest place to be during this pandemic. You should continue trying to stay home as much as possible, because the virus is still circulating at a very high rate in many communities. But whether you need to for work or you’re simply tired of looking at your home’s walls, there are ways to mitigate risk when you go out. if you want to do something outside your home, it’s better to take advantage of the fresh air and do it outdoors rather than indoors when possible. If you want to meet with certain friends or family, consider a pact with them in which you’ll both agree to minimize or eliminate contact with anyone else, to reduce overall exposure for everyone involved. The most important thing: Avoid indoor spaces that bring you within 6 feet of people from outside your household for long periods. “It is about density. It is about duration of contact,” according to Cyrus Shahpar, a director at Resolve to Save Lives. So if you’re having friends over, consider hanging out outside (and keep it to a small group). If you want to eat at a restaurant, look for outdoor seating. If you’re going for a run, go to the park, beach, or streets instead of the gym. After some mixed messaging from federal officials early on in the COVID-19 outbreak, there is widespread consensus that people should wear masks when they go out — a surgical or medical mask if they have one, a cloth one if they don’t. The Centers for Disease Control and Prevention recommends masks “in public settings where other social distancing measures are difficult to maintain (e.g., grocery stores and pharmacies), especially in areas of significant community-based transmission.” But other experts — and, in some cases, government mandates — go further, saying you should wear a mask in just about any setting outside your home as long as the pandemic continues. The primary reason for a mask is to stop transmission from the wearer to others, particularly from people who are infected but asymptomatic and therefore might not even know they’re infected. If you wear a mask, you’re less likely to spray virus-containing droplets on surfaces or other people when you breathe, talk, sing, laugh, sigh, snort, cough, sneeze, and whatever else you might do with your mouth and nose. One of the common pieces of advice throughout this pandemic has been to keep 6 feet or more away from people you don’t live with, summarized by the catchy slogan “6 feet distance determines our existence.” The closer you are to someone, the likelier they are to shed their coronavirus all over you, and vice versa. Whether you’re leaving your home because you have to for food or work, or you’re going out because you can’t stand the sight of your apartment anymore, one way to minimize risk is to space out all your trips. With every venture outside, you are putting yourself at risk of contracting COVID-19 in a world that’s still engulfed by a pandemic. ALWAYS wash your hands frequently, and don’t touch your face. If you’re going to frequently venture far outside your home, that advice is especially pertinent. Take hand sanitizer to use religiously and wear gloves whenever possible. Stay Safe, Stay Healthy, Stay Home Whenever Possible |

Kim N. Bregman

Kim N. Bregman