Blog

February 27, 2023

The National Flood Insurance Program is a pre-disaster flood mitigation and insurance protection program designed to reduce the escalating cost of disasters. The National Flood Insurance Program makes federally backed flood insurance available to residents and business owners. Standard flood insurance by the National Flood Insurance Program generally covers physical damages directly caused by flooding within the limits of the coverage purchased. Private providers may have higher limits or broader coverage compared to National Flood Insurance Program policies.

A flood insurance policy is intended to cover physical damage to your building or personal property “directly” caused by a flood. Flood…

February 6, 2023

Homeowners beware.

With the potential of a recession and rising mortgage rates; lenders are seeing fewer loan applications and many buyers are not able to qualify for legitimate loans. Homeowners are often coerced into using the equity in their homes to pay off debt, finance unexpected expenses and to cover job losses, etc.

Lenders that over promise are likely to be ones to stay away from. If you cannot qualify for a mortgage with a reputable financial institution if is best to wait to purchase a home until you can.

What Is Mortgage Fraud?

Any misrepresentation of information on a home loan application can be…

December 1, 2022

If you’ve been house-hunting in recent years, you’ve really been through it. Maybe you were waiting out the market, hoping the rocketing prices would start to flatten. Now, of course, they have — but between 2021 and 2022, mortgage rates have more than doubled, from less than 3 percent to more than 7 percent.

If you are renting and trying to save for a down-payment, the cost of your rental has likely increased as well.

Sellers who are sitting on low mortgage rates are not listing their homes for sale and supply shortages, cost of land, and cost…

September 24, 2022

It is always advisable to shop for a mortgage, but as rates rise the savings can be significant. Each lender offers different loan programs and sets different borrower requirements. It’s important that you get quotes from several types of financial institutions, mortgage lenders, and brokers to find one that offers the best loan program for you.

Banks

Banks are for-profit financial institutions that typically offer several different products such as mortgages, credit cards, checking and savings accounts, and more. Many large banks have branches nationwide or throughout a specific region where you can get in-person support, and they also might offer a wider…

August 29, 2022

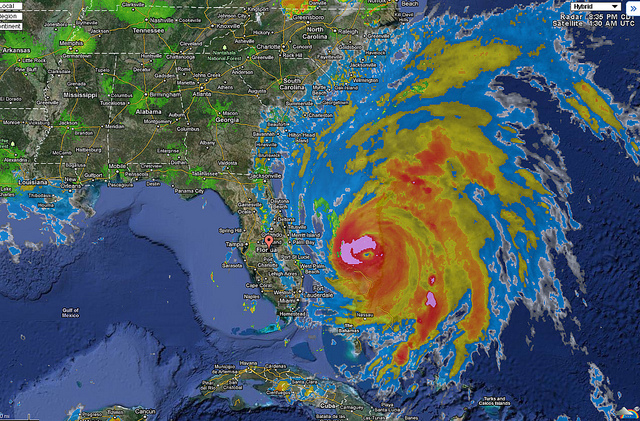

2023 Hurricane Preparedness Guide

Look carefully at the safety actions associated with each…

Kim N. Bregman

Kim N. Bregman