Blog

August 29, 2022

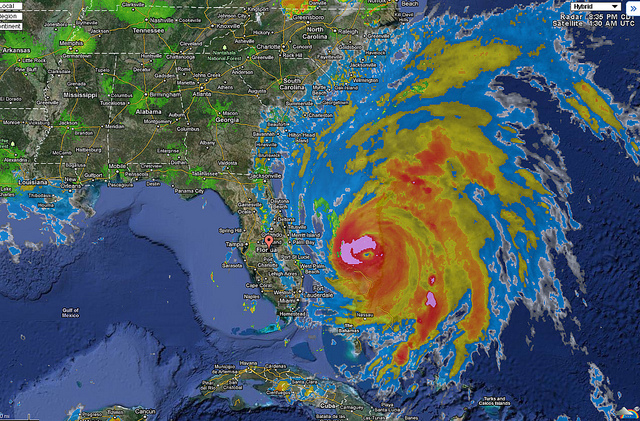

2023 Hurricane Preparedness Guide

Look carefully at the safety actions associated with each…

July 24, 2022

Spiraling mortgage rates on top of record-high and still-rising home prices are leading many experts to predict the real estate market is on the verge of a correction—if it isn’t already in one. They anticipate home prices will flatten, or even go down a bit, in certain markets.

The result is that new buyers would be paying about 50% more for the same home compared with a year ago in their monthly mortgage bills. And that’s greatly diminishing the buying power of many Americans—especially during a time when inflation has hit a 40-year high, gas prices have spiked,…

June 30, 2022

More sellers want to stay in their home after closing, sometimes for weeks or months. In many cases, they want to do it for a fraction of the fair market rent or even for free. Agreeing to their request gives some buyers an edge over the competition in a bidding war, but it comes with risks.

The Post-Closing Occupancy Agreement allows the Seller to remain in the property for a designated period after the Buyer takes ownership of the property. As easy as a post- occupancy agreement sounds, there are serious implications arising out of a…

May 26, 2022

Homeowner’s insurance costs are increasing nationwide and is becoming a larger expenditure in the homeowner’s budget.

Florida homeowners insurance costs vary depending on where you live, the age of your home, your home’s characteristics, and other factors. In addition to the cost of the home, the on-going expense of insuring a property should be a consideration when selecting the home you want to purchase. It may prove beneficial to purchase, for a little more money, a new home with impact glass, a new roof, updated plumbing and electrical and one that is not frame construction.

Several factors affect how much homeowner insurance costs…

April 23, 2022

Companies such as Airbnb and VRBO have brought the short-term rental market into the mainstream, making it easier than ever for investors to profit from real estate ownership.

Rather than getting tied into long-term leases, property owners can capitalize on local demand for temporary and vacation rental housing. In recent years, the industry has transformed from a side-gig for homeowners looking to make extra income into a booming industry in many markets across the country.

Although considered great investments, these types of properties require proper management and good knowledge of a local real estate market.

A short-term rental is a…

March 17, 2022

Interest rates are rising and so it the equity in your current real estate holdings. There are alternatives to financing a second home or investment property other than a traditional mortgage. If you have a large amount of equity in your first home, you could obtain enough money through a Home Equity Loan to pay for most—if not all—of the cost of a second home.

Using a home equity loan (also called a second mortgage) to purchase another home can eliminate or reduce a homeowner’s out-of-pocket expenses. However, taking equity out of your home to buy another house comes with risks.

If you’re…

February 15, 2022

Buying a home and moving is stressful on many levels. Here are some Apps to make the moving an easier endeavor. Like other productivity apps that can be downloaded on your smartphone, move-planning apps will help you keep everything organized.

Dolly: So you’ve arrived at your new home and realized you don’t have the person-power to haul that bedroom furniture upstairs? No problem! Dolly (free, iOS, Android) connects you with helpful delivery people looking to make a few bucks. These strong-backed guys and gals have no qualms about carrying your furniture to its new resting place in your new home and…

January 26, 2022

Closing costs are inevitable when you’re buying or selling a property. While they vary from state to state, the amount you’ll pay in Florida depends on both the property and the county it sits in. As a buyer, you’ll have to cover most of the fees and taxes. In Florida, you’ll also have to post a fee for documentary stamps (or doc stamps), which is a percentage of the sales price. Then there are the taxes. You’ll likely be subject to property and transfer taxes.

Neither party is responsible for 100% of the closing costs in Florida, which includes fees,…

December 27, 2021

Nationally, expect slower housing price appreciation, easing inflation and rising interest rates in 2022, according to a survey of more than 20 top U.S. economic and housing experts by the National Association of Realtors® (NAR). “Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,” Yun said. “Though forecasted to rise 4%, inflation will decelerate after hefty gains in 2021, while home price increases are also expected to ease with an annual appreciation of less than 6%. Slowing price growth will partly be the consequence of interest rate hikes by the Federal Reserve.”

Fed boosts…

Kim N. Bregman

Kim N. Bregman